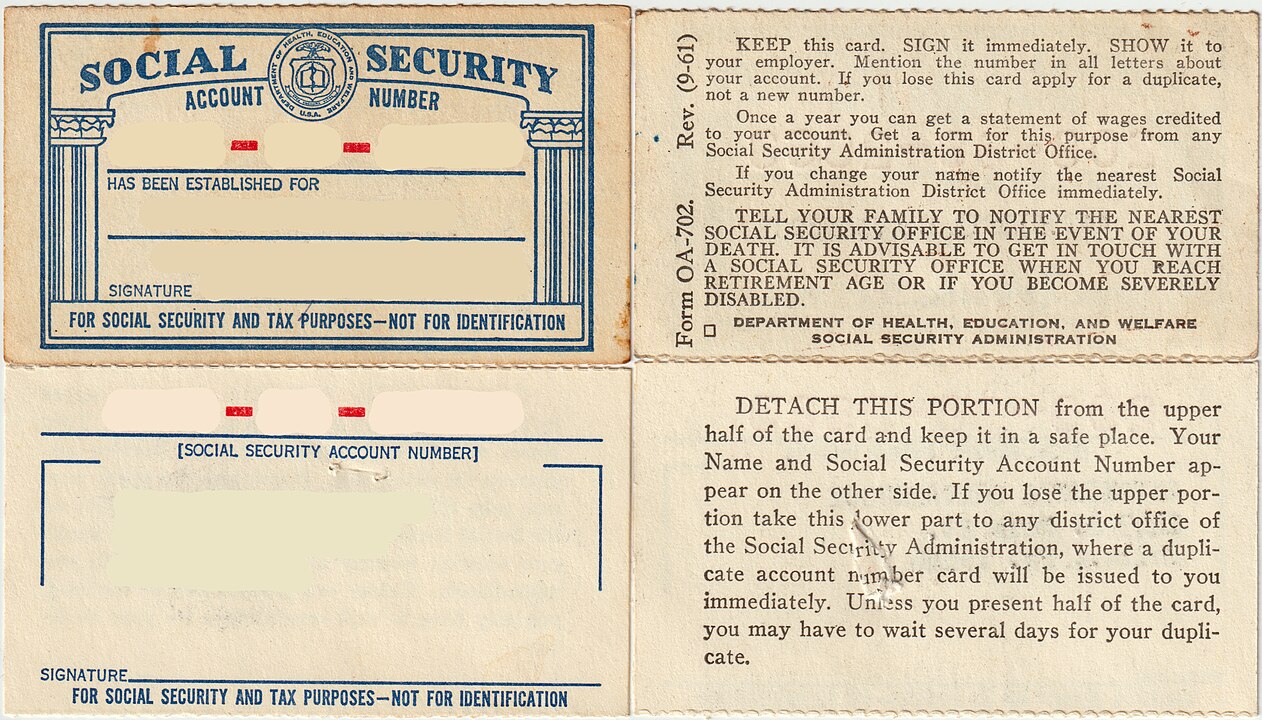

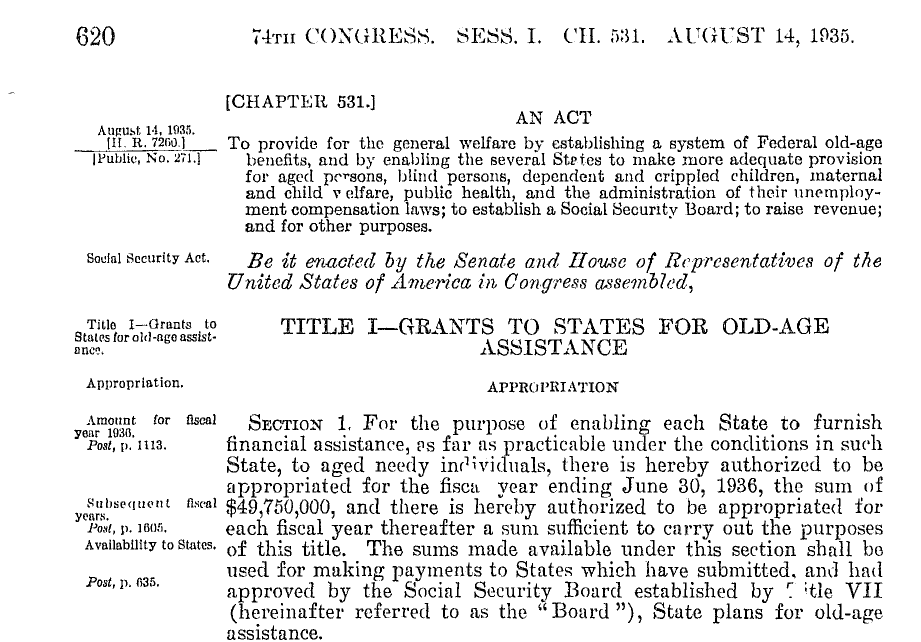

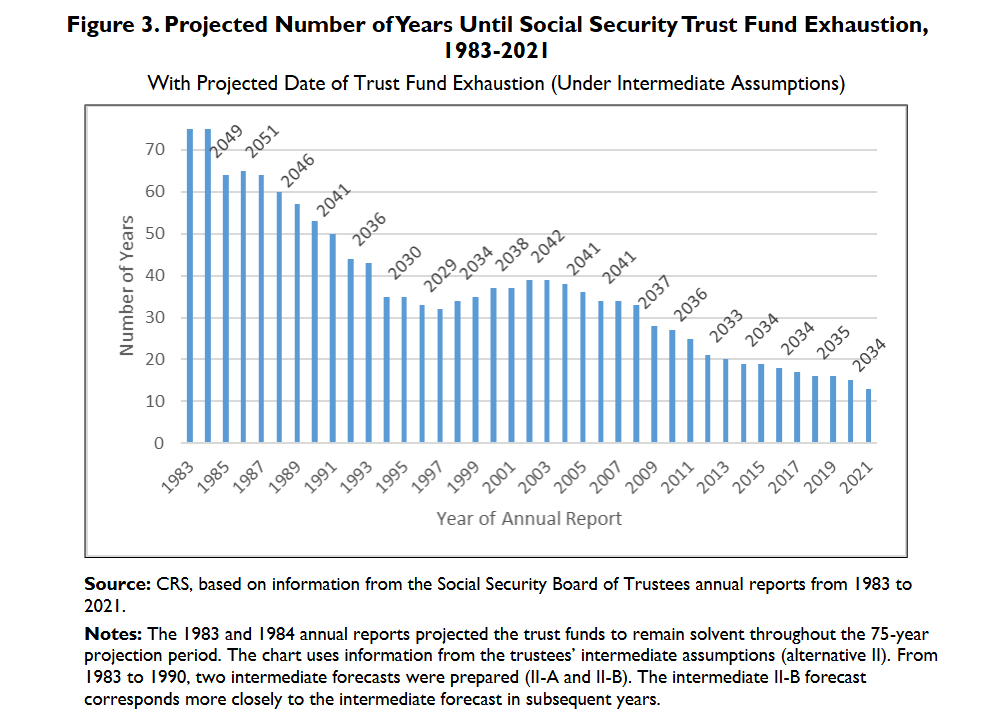

Many reading this blog may wonder — will Social Security be around to celebrate it’s 100th Birthday? Full retirement age has increased over the years, as has the percentage paid by employer and employee. 90 year old Social Security does look different than its younger self, and statistics indicate that centenarian Social Security will have a few more wrinkles (and aches and pains) than it does currently….